TaxCalc AU app for iPhone and iPad

Developer: Xiao Ting Liu

First release : 07 Apr 2016

App size: 15.18 Mb

TaxCalc AU is an easy to use Australian income tax calculator. It helps you:

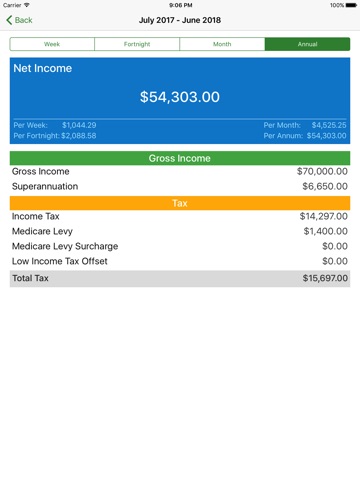

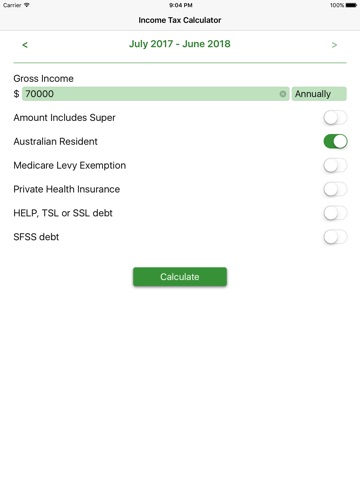

- Estimate how much tax you pay

- Estimate your take home net income

- Estimate your employer superannuation contribution

- Estimate your medicare levy and medicare levy surcharge

- Find out your low income tax offset

- Calculate HELP and SFSS repayment

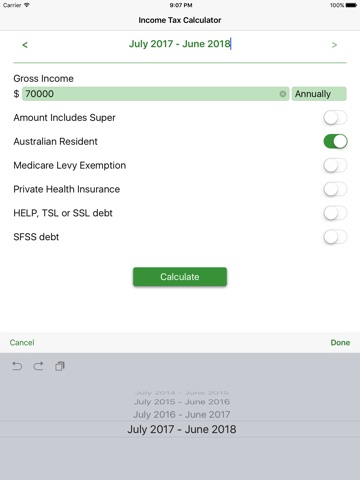

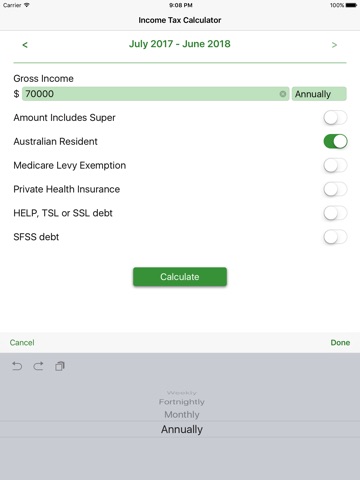

- Gross income can be entered annually, monthly, fortnightly and weekly

- Calculation results are shown on a annually, monthly, fortnightly and weekly basis

Please note:

- The calculations should be considered indicative only and not as professional tax advice. The actual tax you are paying could be different depending on your personal tax circumstances. For more complicated tax matters, consult your tax adviser.

- Net Income is your take home income, derived by your Gross Income take away Total Tax.

- The Temporary Budget Repair Levy payable for taxable income over $180,000 is included in the Income Tax total.

- To exempt from the medicare levy surcharge, you will need an appropriate level of private patient hospital cover for the full year. By setting “Private Health Insurance” to YES in the App, the calculations will assume you have the appropriate level of private patient hospital cover.

- Medicare levy is based on standard individual rates and does not take into account family income or dependent children. And it also does not take into account the different thresholds for Senior Australian and Pensioner Tax Offset claimants.

- Medicare levy surcharge is based on standard individual rates and does not take into account family income or dependent children.

- The calculations currently do not support partial medicare levy exemption.

- The calculations do not take into account any tax deductions.